What Best Describes a Fractional Reserve Banking System

A banking system in which banks have only partial control over the interest rates they charge on loans. The Fed imposes a.

Is The Fractional Reserve Banking System A Form Of Fraud Quora

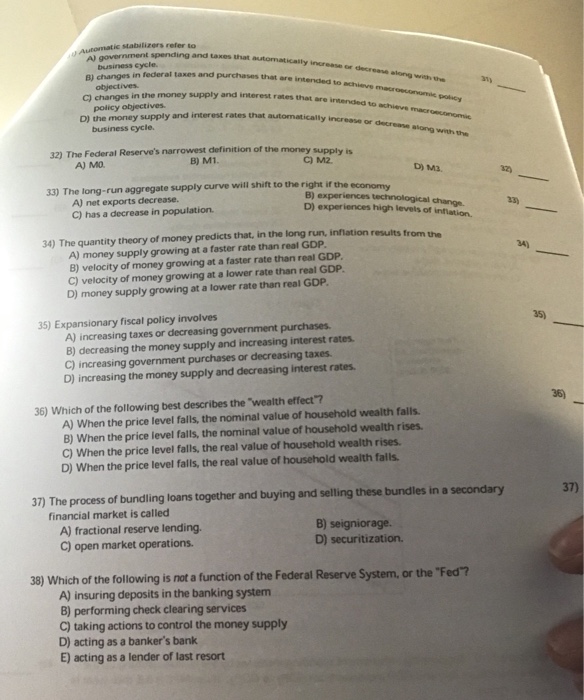

Both the money multiplier and the money supply decrease.

. What describes a fractional reserve banking system. Group of answer choices Commercial banks are required to hold 100 of their deposits to meet the liquidity needs. A banking system in which banks keep a.

A banking system in which net worth is calculated by subtracting a fraction of liabilities from assets. A fractional reserve banking system holds a small portion of the money as a margin in a bank and then uses that to make loans. A banking system in which banks keep a portion of deposits on hand to.

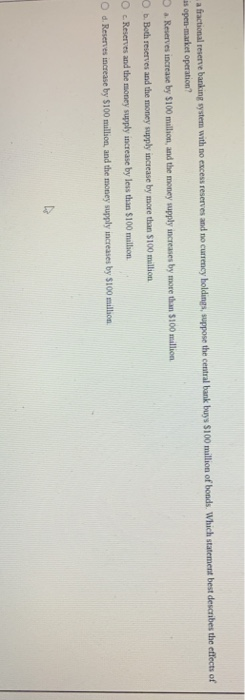

Which of the following best describes a fractional reserve banking system. Which is an asset. Both the money multiplier and the money supply increase.

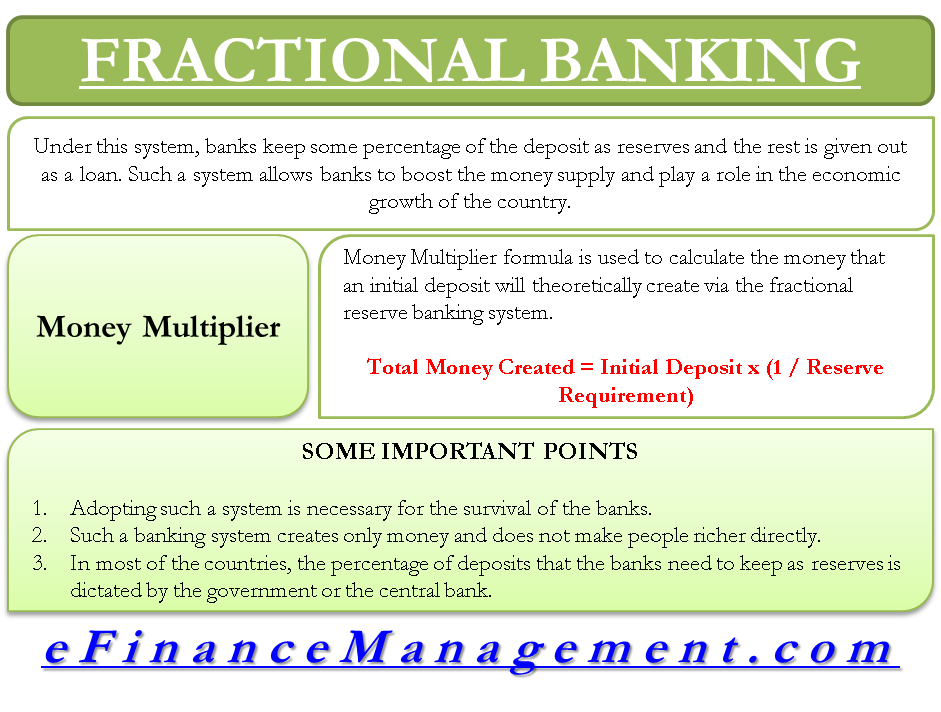

This allows them to use the rest of it to make loans and thereby essentially create new money. Fractional reserve banking is a banking system in which banks only hold a fraction of the money their customers deposit as reserves. Which best explains the difference between fiat money and commodity money.

A banking system in which banks keep a portion of deposits on hand to satisfy their customers demands for withdrawals. A banking system in which net worth is calculated by subtracting a fraction of liabilities from assets. This gives commercial banks the power to directly affect the money supply.

Banks keep a portion of deposits on hand to satisfy their customers demands for withdrawals. How The Fractional-Reserve Banking System Works and The Creation of Money. The fractional reserve banking is necessary as it helps thebanks satisfy the demands for withdrawals.

Banks loan out a percentage of their deposits to households. A banking system in which net worth is calculated by subtracting a fraction of liabilities from assets. Hand to satisfy their customers demands for withdrawals.

A banking system in which banks have only partial control over the interest rates they charge on loans. It refers to thepractice whereby a given bank holds reserves that are less than theamount of. QUESTION 2 Which of the following best explains the correct reason why the Fed imposes a require reserve requirement on member banks and maintains a fractional reserve banking system.

Which of the following best describes a fractional reserve banking system. Economy by controlling the money supply. What statement best describes a fractional reserve banking system.

As a result new money is generated by making loans out of the rest. Commodity money can be used for some other purpose while fiat money can only be used as a medium of exchange. A banking system in which a large portion of the banks assets are digital.

Which of the following best describes the basic idea of fractional reserve banking. The Federal Reserve is required to pay interest on commercial bank reserves. Essentially this gives commercial banks.

Fractional-reserve banking is a banking system in which banks hold a portion of customer deposits in reserves and use the rest in loans to other customers. It involves banks accepting deposits from customers and making loans to borrowers Advertisement. This system uses money that would otherwise be idle in bank accounts for lending allowing consumers to continue borrowing and spending which helps the economy grow.

A banking system in which banks have only partial control over the interest rates they charge on loans. A banking system in which banks keep a portion of deposits on. What statement best describes a fractional reserve banking system.

Specifically the creation of money its propagation into. Which of the following best describes a fractional reserve banking system. Which of the following best describes a fractional reserve banking system.

The money multiplier increases but the money supply decreases. A banking system in which a large portion of the banks assets are digital money rather than bills and coins. Through the lens of cryptocurrencies and how they represent an alternative to the modern Fractional-Reserve Banking system it is best to understand the intricacies of the flow of money in the FRB model.

A banking system in which banks keep a portion of deposits on hand to satisfy their customers demands for withdrawals. The Fractional reserve banking is a system where the banks hold some fraction of the customers deposit as reserves and the rest are used to generate returns in the form of interest rates on loans. Which of the following best.

Which of the following best describes a fractional reserve banking system. Which of the following best describes the purpose of the Federal Reserve Bank. A banking system in which banks keep a portion of deposits on hand to satisfy their customers demands for withdrawals.

Fractional-reserve banking is the most common form of banking practiced by commercial banks worldwide. Why is a. The United States banking system practices the fractional reserve banking because its allows the commercial banks to get interest on customers deposits with.

The Fed uses the required reserve ratio to ensure that banks will have sufficient reserves when consumers seek to withdraw their deposits b. Which of the following best explains how a barter system works. Which statement best describes the outcomes of a decrease in the reserve requirement in a fractional reserve system.

Fractional Reserve Banking Prepnuggets

Fractional Reserve Banking Definition Characteristics Seeking Alpha

Tourism Multiplier Effect India Dictionary

Bitcoin Prevents Fractional Reserve Lending Trading Courses Bitcoin Prevention

Chapter 11 Mc Docx Eco2306 Macroeconomics Exploring Macroeconomics 5th Edition Chapter 11 Money And The Banking System Multiple Choice 1 How Is Course Hero

Which Of The Following Best Describes A Fractional Reserve Banking System A A Banking System In Brainly Com

Pdf Full Reserve Requirement Banking System For The Community Economic Sustainability

Solved 34 In A Fractional Reserve Banking System An Chegg Com

Chapter 11 Mc Docx Eco2306 Macroeconomics Exploring Macroeconomics 5th Edition Chapter 11 Money And The Banking System Multiple Choice 1 How Is Course Hero

Solved 18 In A Fractional Reserve Banking System With No Chegg Com

Solved A Fractional Reserve Banking System With No Excess Chegg Com

Smartassets Investments Bringing Intention Into Investing

Which Of The Following Describes The Practice Of Fractional Reserve Banking 1 Point The United Brainly Com

Solved Ic Stabilizers Refer To Spending And Taxes That Totly Chegg Com

Which Of The Following Best Describes A Fractional Reserve Banking System O A A Banking System In Brainly Com

Is The Fractional Reserve Banking System A Form Of Fraud Quora

Crypto Banking 101 This Paper Describes The Business Of By Sebastien Derivaux Medium

Solved Question1 Which Statement Best Describes Fractional Chegg Com

Comments

Post a Comment